#1 Product Deep Dive: How to make me pay for Loom

Deep dive into a product I love.

Loom is the primary tool I use for internal communication at Jobber. When meetings run late there is a common suggestion to "pull a Connor" which effectively means “Go record a Loom and post it to the appropriate Slack channel.” To give you some context on my own usage, I’ve recorded 85 videos, and I’ve managed to get everything I need out of Loom using only their free plan.

Job-to-be-done (JTBD): When I need to communicate an experiment, update, or strategy to the company, I want to use Loom so I can avoid costly meetings, be clear in my messaging, and play into my strengths as a verbal communicator.

They've successfully raised 45 million dollars in funding, have ~100 employees, and have grown a strong user base claiming over 4 million users across 90,000 companies.

How does Loom Grow?

Loom's initial launch was via Product Hunt as a screen recording Chrome Extension. They acquired their first 3,000 users on launch day. After launch, they focused on customer advocacy to power referrals pushing them over 20K users. Today, their main acquisition strategy is centered around product-led growth (PLG). Loom has a powerful acquisition loop that turns viewers into new users.

The so-called PLG strategy goes like this. As I share videos in Slack, more and more employees are exposed to Loom for the first time. These viewers may not signup for Loom right away, but over time they will run into pain points that Loom can solve. There’s no question that the pandemic has supercharged this PLG acquisition strategy. At Jobber I've seen another 8+ employees using Loom on their respective teams to assist with internal communication.

How does Loom upgrade free users?

They have over 4 million users (lucky them!). But how many are paying? It’s hard to say, but I’m going to make some gross assumptions to satisfy my obsession with freemium business models and hopefully stir up some constructive debate over their approach to freemium.

Loom raised their Series A at 11M in late 2018, they then raised their Series B at 30M 1 year later. These rounds being so close together suggests the need for capital to continue product development and acquisition of free users in the down market while building headcount in marketing & sales to acquire paying subscribers.

Free to Paid

Traditional freemium conversion rates have a broad spectrum from 1-10% free to paid conversion rate. Let's be optimistic and split the difference at 5%.

4,000,000 * 5% = 200,000 Paying users

Diving into their pricing, these prices are at a 50% discount for their Pro plan for COVID-19 so let's adjust these to the normal price of Pro at $10/mo. Their team's based plans are new and are in BETA so let's also assume the paying users are primarily at the Pro price point for an ARPU of ~$10.

Taking all of my gross assumptions into consideration:

200,000 users x $10 = $2,000,000 MRR x 12 months = $24,000,000 in ARR

To me, this is optimistic. I would probably estimate < 5% free to paid conversion rate closer to the 3% mark representing 120K paying users and 14.5M in ARR.

Regardless, this paints the picture that investment into Loom is based on their ability to monetize their free base of users. In addition, the $10/mo price point isn't going to cut it. So they have shifted into business & enterprise plans to increase ARPU (more on that later).

This can be a tricky position to be in:

“Like most marketing tactics, some will find success with Freemium, and others will fail miserably. If you understand that it is simply a marketing ploy and don’t build your “business” around Freemium, when it doesn’t work, you will be in a better position to recover. If you spend all of your time, money, and resources upfront attempting to collect some “critical mass” of users thinking that you’ll convert them later when you “turn on the revenue tap” you might have a big, negative surprise waiting for you.”

— Lincoln Murphey

Free Upgrades to PRO

Currently, free users get screen & cam recording, comments & reactions, and viewer insights. The Pro plan introduces a drawing tool, custom recording dimensions, and the ability to add calls-to-action. As we know, leaning on premium features as upgrade paths isn't a sound strategy, so the main upgrade path is their 25 video limit.

I don't worry about the limit. The majority of updates and presentations I do via Loom are one-off. If I need to save a video, I download the video file and upload it to our Google Drive. Perhaps I'm a unique case, but this is how I avoid a $10/mo price point.

When looking to upgrade, it doesn't need to be an immediate purchase. I can do a free trial of the Pro plan to experience the premium features rather than blindly buy them hoping they match my expectations. So far, those premium features have not been enough for me to be motivated to go through the free trial of the Pro plan.

Some bold suggestions to adjust the free plan:

Remove cam recording (I would be so mad)

Can only record a tab or window on the free plan (no desktop)

Can't download the file (this would make me pay)

Pull a Zoom and put a time limit on free videos (use data to find the right number)

Reduce the 25 video limit

I would build cohorts for users that record at least 1 video, 2 videos, 3 videos, and so on. Then, I would look at their retention curves to identify at what point a user adopts the habit of using Loom on a weekly basis (guessing WAU is their targeted usage interval)

Experimenting with these options can be tricky, but Loom shouldn't shy away from monetization experiments given the volume of free users they acquire.

Where is Loom going?

Okay, so we talked about the downmarket with their Basic and Pro plan. Moving upmarket, Loom launched Loom "For Teams", introducing a Business and Enterprise plan. Classic!

Pricing page - June 2020 (50% discount on their Pro plan during COVID-19)

The business use cases are simple. This technology can be used to double down on asynchronous communication to remove useless meetings and be more productive at work. Internally, this is looking at all the collaboration opportunities inside of specific departments but also cross-functionally. Externally, we can see opportunities for sales, customer success, and customer support to use Loom to add a personal touch to their interactions with customers and prospects as well as clear visualizations when demoing the product or showing a customer "how to do X".

I'm sure the business operations team at Loom is having fun moving upmarket trying to get a solid pipeline together in Salesforce for the new sales team they are adding. Combing through email addresses to find multiple employees using Loom is the lowest hanging fruit for the company to identify a solid pipeline early on. "Hey, did you know 50 employees are using Loom at your company?" - would be a great line to have in your back pocket.

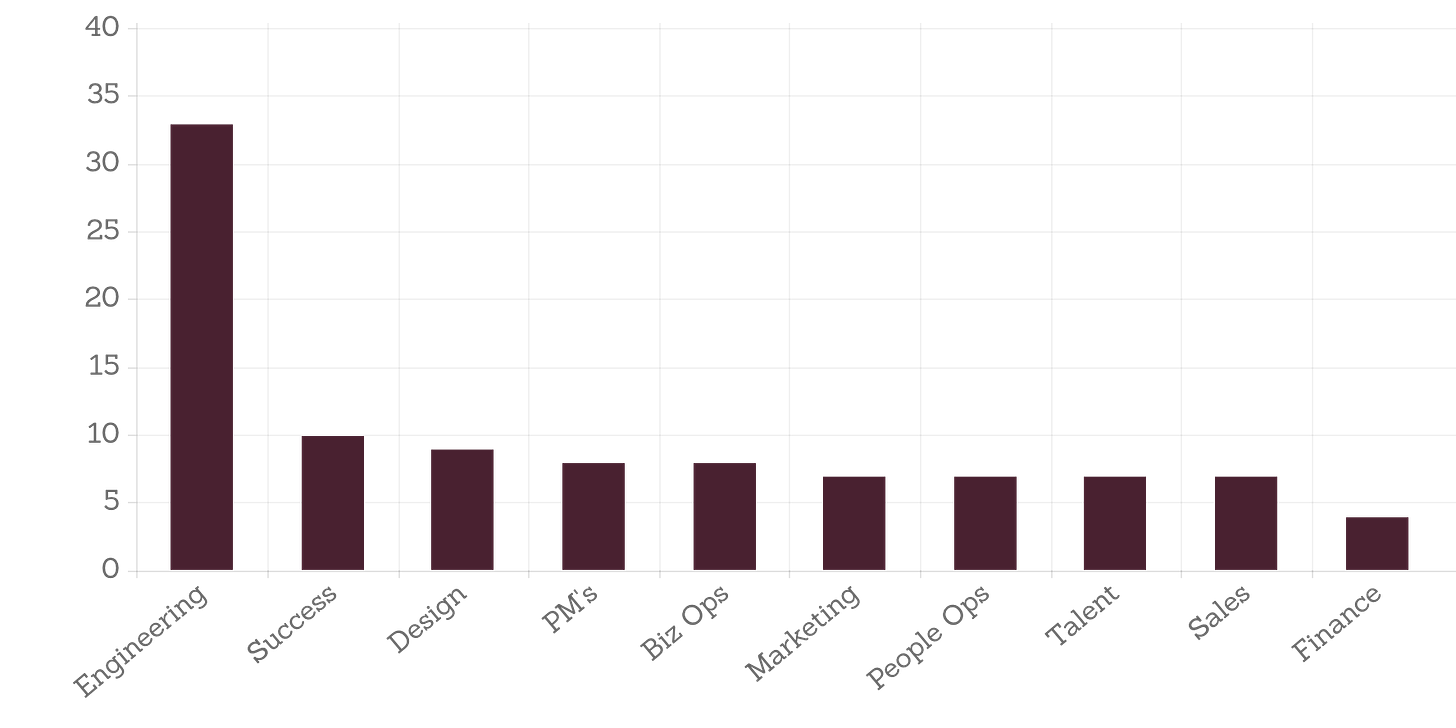

We can see that the sales & marketing inside of Loom is still early and looking to grow. LinkedIn is never a perfect measure, but it does give us a general picture of Loom's resourcing and where they are heading:

via LinkedIn

Their new sales leader is heading up sales and success. He will need to work closely with the biz ops team to prioritize sales operations with a proper CRM & pipeline. In addition, the success team will be hard at work looking to expand the independent paying users into the new business plans they created. Business operations should look at free and pro users that are sharing their videos in Slack, Jira, Notion, and more. Even if multiple employees are not using Loom, being informed that the company is being exposed to Loom would be enough for me to target the buyer.

Yet, it will be difficult to identify that buyer from a sales perspective. You have a marketing coordinator actively using Loom, do you reach out to that coordinator? Do you find the Director of Marketing via LinkedIn and send off a message? The decision-makers and buyer personas will need to be fleshed out for business & enterprise plans.

Loom's product development should shift to the team and enterprise plans to further differentiate themselves to justify the higher ARPU. As with any business, this will cause tension and a mental shift when adding sales priorities and revenue-based decisions into product development.

From a marketing perspective, they may start testing paid channels with the intent of bringing in leads for the business and enterprise plan. In general, I would focus efforts on acquiring free and pro users to continue to build a base of leads primed for MQL or PQL triggers. What those triggers are would be my top priority for the biz ops team to bridge marketing and sales.

My assumption to resource Loom in preparation for moving upmarket may be off given the jobs they are hiring for currently. Yet, it will only be a matter of time. Perhaps they need to nail down their systems and operations before scaling their sales & marketing teams.

Overall

Loom has taken a screen recording and turned it into a value proposition that challenges how companies communicate. The value they provide is undeniable. I've felt it first hand by doubling down on asynchronous communication within my team.

Yet, the flexibility of the free plan has me worried. My video library is full of videos that were recorded for a quick explanation or presentation of my work. I forget about them like a deck that gets forever lost in Google Drive. If I need to keep a video, I download the file and upload it into Slack or Google Drive.

As Loom moves upmarket, they will take millions of users and find opportunities to upgrade them into their business and enterprise plans. My concern is these videos are already being organized inside a company; Slack is completing that job alongside the proper threads and text communication needed, all in one place.

Loom will need to further differentiate their product past a screen recording. If a company like Zoom or Slack decides to jump in, their distribution in the B2B space would make it difficult for Loom to scale as companies look to simplify their tech stack, not add to it.

With that said, they have a kick-ass product, built-in acquisition loops, and incredibly smart people. So, I'm hopeful this company will keep pushing and continue to change the way companies communicate at work.